"Futures" are financial instruments used to predict future changes in the underlying asset

Johannes Röll

26 / April / 22

Visitors: 923

Johannes Röll

26 / April / 22

Visitors: 923

Future ones.

"Futures" are financial instruments used to predict future changes in the underlying asset (stocks, stock index, etc.): You buy or sell a certain amount of this underlying asset at maturity and at a predetermined price. But futures are very risky speculative products.

Warning.

Futures are risky speculative products. They do not in any way satisfy medium- or long-term investment needs. Don't invest if : - you don't want to risk your savings, - you don't understand how these products work. If you invest: - spend only a small part of your savings on this (no more than 5%) - invest in these products only on websites authorized in France by checking their license and permission on the REGAFI website (Register of financial Agents).

What is the future ?

A future is a futures contract under which two parties undertake to buy or sell a certain amount of an underlying asset (for example, a stock or stock index) at maturity and at a pre-agreed price. It allows you to predict future changes in the underlying asset and, therefore, can be used to hedge the portfolio against future market fluctuations. It also helps to improve the performance of your portfolio. The future is a firm commitment, it must be fulfilled on the maturity date by its counterparties: the buyer of the future must buy the underlying asset at an agreed price, and the seller must deliver the asset.

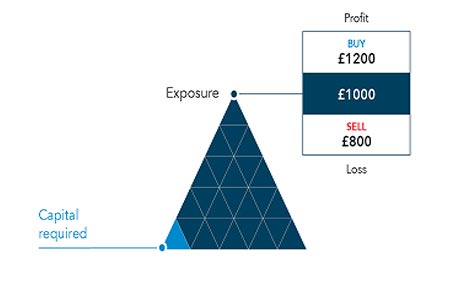

During the purchase (you expect an increase in the underlying asset) or sale (you expect a decrease in the underlying asset), the future requires a deposit. This is a pledge that ensures the proper completion of operations in the event of non-fulfillment of obligations by one or the parties. Then every day after the market closes, you receive notifications about margin calls. They correspond to the profit or loss on your position and depend on whether you have achieved (or not) your expectation. Thus, in case of a good expectation, you are the beneficiary of a margin call. Otherwise, you are responsible for the margin call. If the balance on your account is not enough to pay for a margin call, your position may be canceled, and the security deposit is used to pay for a margin call.

How to fix its position ?

Throughout the life of the future, you can unravel your situation. This decision turns out to be mandatory, especially when your expectation seems to deviate from reality. To do this, you just need to take the opposite position in the starting position! If you wait until the deadline arrives, the operation will be automatically canceled. This leads either to payment on the last margin call, or to the surrender of the underlying asset. Liquidation or cancellation of future maturities occurs on the 3rd Friday of each month.

How to invest in futures ?

In Paris, futures are traded on a regulated derivatives market called LIFFE. They can be bought and sold throughout their entire service life through an intermediary, a broker who directs orders to the market. Euronext guarantees you that your order will be executed correctly and the procedure will be carried out in accordance with the rules.

What are the risks of investing in the future ?

If the initial guarantee deposit is low, the investor receives leverage. Be careful, leverage works both up and down. This means that it increases both profits and losses. Any expectation that contradicts the market sense can quickly lead to significant financial losses. Therefore, it is extremely important to closely monitor the actual development of the underlying factor in order to detach an unfavorable position in time.

Good practice before investing.

Futures are intended only for experienced investors who are well aware of the financial markets and, in particular, what the futures contract is based on. Before investing, make sure that futures match your goals and your risk sensitivity. Remember that futures are short-term speculative products. The future is a very risky tool. He uses leverage, which increases both profits and potential losses. This is a firm contract that obliges its counterparties. A security deposit is requested (from 5% to 10% of the future value), and margin calls are paid in case of possible profits or losses. The future is subject to discussion throughout its lifetime.

Focus: expenses related to investments in futures.

A transaction fee is charged for futures trading. They differ from one intermediary to another. Feel free to ask your usual financial intermediary.

Johannes Röll

Johannes Röll was born 1978 in Brilon,Germany. Graduated RWTH Aachen University. Over the past ten years he worked as Head of the plastic card team, where he was mainly responsible for the development of the distribution, Head of sales Department and Financial Analyst,where he got experience in planning and support sales figures for branches. For the present he works as freelancer